The Malta Private Trust Company (PTC) provides an excellent solution to those families that wish to retain a higher degree of control in the family trust, without losing any of the benefits offered by a trust, as well as family offices that may wish to act as trustee for a limited number of clients.

A Malta PTC is a privately owned corporate trustee that acts as the trustee of trusts of up to five settlors. In a family context, the board of directors is often constituted of the same family members and their trusted advisors. The PTC caters for the possibility for family members influencing the administration of a trust. Family offices and advisers have found the Malta Private Trust Company to be an excellent tool to retain more control over the assets of a handful of their clients.

Malta PTCs are considered to be an attractive option to incorporate within a family estate plan to provide for the administration of Malta family trusts, due to the simple and quick process of registration as well as, the certainty of the process through rules published by the Malta Financial Services Authority (MFSA). A Malta family trust is created to hold property settled by the settlor/s for the present and future needs of family members and dependants.

Malta Private Trust Company Overview

Some quick information about a Malta Private Trust Company:

- A Malta PTC is incorporated as a limited liability company (Ltd)

- Family members involved in the trust may act as directors of the PTC

- PTCs are governed through Article 43B in the Malta Trusts and Trustees Act.

- PTCs are further regulated by the Rules on Trustees of Family Trusts (MFSA)

Benefits of a Malta Private Trust Company

- Families retain greater influence over the family assets

- A PTC reduces the need to involve outsiders in family patrimony

- A PTC requires a registration process with the MFSA

- PTC enjoy attractive tax regime

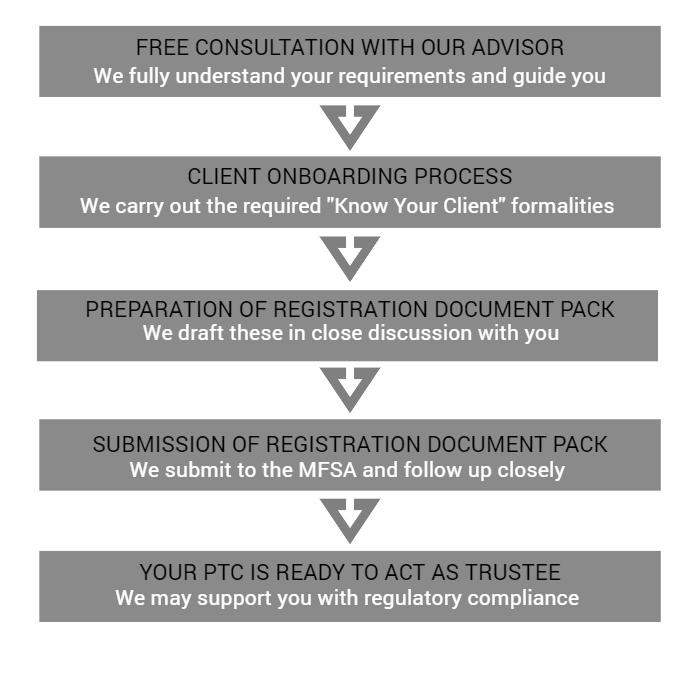

The Process for Malta Trust Formation

The procedure to Establish a trust in Malta is simple:

Apart from handholding you through the MFSA registration process, we assist you with the ongoing regulatory compliance of the Private Trust Company as well as all the other services you may require for your personal or family wealth protection strategy:

- Tax advice and tax compliance

- Corporate support

- Family business review and governance

- Real Estate investment advisory

- Personal immigration options

Overview of Tax on a Malta Private Trust Company

A Private Trust Company is deemed to be an operational or trading company, as such it will enjoy all the benefits that a trading company may qualify for. A PTC owned by non-Malta resident shareholders would generally qualify for the 6/7ths tax refund mechanism.

- Anti-abuse provisions must be met – these provide certainty

- Worldwide income is taxable, subject to relief

- No tax is applied on Capital remitted to Malta

- Tax refund regime and possibility of consolidated tax reporting

- Participation Exemption for holding assets

- Notional Interest Deduction

- 70+ Double Tax Treaties in force

Operating or Trading Companies owned by non-resident beneficial owners may benefit from an effective tax rate as low as 5% with the right guidance.

We specialise in providing tax advice to clients of every size at any stage of their Wealth and asset protection planning, be it pre-setup, specific to a transaction, or in relation to disposal of any family or business asset.

Our Private Wealth Team

On matters of Private Wealth we have a depth of experience: our 3 Directors and Senior Manager are all TEP, the global benchmark qualification for Trust and Estate Practitioners, and between them offer some 80 years’ experience in the field. We invest continually in our team at all levels and are committed to continuous professional development to benefit our clients.

We have been involved with mainstream assets such as family business, financial portfolios and real estate investments as well as new age holdings such as virtual and digital assets.