Foundations in Malta are governed through the country’s Civil Code. Any person acting as a foundation administrator in Malta requires authorisation from the Malta Financial Services Authority (MFSA). We offer Foundation administration and related services through Claris Capital Ltd, duly authorised for over 15 years.

Foundation administrators are subject to rigorous responsibilities, chief amongst which is an overriding requirement to act always in the best interest of the beneficiaries of the foundation on which they act.

Foundations set up under Maltese law offer you a secure and adaptable tool within your overall wealth protection or succession planning strategy. A Malta Foundation is not permitted to carry out commercial activities, however these may be carried out within a company owned by the Foundation. A Malta Foundation is an ideal legal entity within which to hold any manner of investment.

Foundations lend themselves to many purposes such as, organising charitable causes or philanthropic organisations, as well as being a flexible entity within which to organise your wealth protection and legacy planning strategy. One key difference from a trust is that a foundation is a separate legal entity and may therefore own assets and enter into contracts in its own right.

Benefits of a Malta Foundation include attractive tax treatment, segregation of patrimony and the possibility to own assets and arrange bank accounts or financial holdings without needing to visit Malta in person. Through Claris Capital Ltd we set up the foundation and handle the ongoing administration providing you the comfort that your legacy is in competent hands.

Malta Foundations Overview

Some quick information about establishing a Malta Foundation:

- A Malta Foundation is set up through public notarial deed

- A Foundation may be established during the founder’s lifetime or as specified in his/her will (final testament).

- Settlement may be done remotely – there is no need to visit Malta

- A Foundation requires at least one administrator and one beneficiary as well as A minimum an initial endowment of 1,160 Euros.

- Malta Foundations are registered with the registrar for legal persons within the Malta Business Registry

- The founder may appoint a protector known as supervisory council to oversee certain trustee actions

- Malta is unique in offering a foundation that may host segregated cells

Benefits of a Malta Foundations

- Segregation of patrimony

- Attractive tax efficient regime

- Qualifying holdings of a Malta Foundation may be tax exempt

- There are no withholding taxes or stamp duties in Malta on Foundation distributions to beneficiaries

- Malta is an EU member state, Foundations in Malta enjoy all the benefits and protections of EU legislation.

- Malta Foundations may hold accounts in banks outside Malta

- Within the Founder’s lifetime, he may add, remove or change the Foundation beneficiaries as well as their beneficial interest

- The founder or supervisory council, if appointed may replace the foundation administrators at any point

- The administrators work within a highly regulated framework that requires them to protect the Foundation assets with attentive diligence.

- It is possible to redomicile to Malta a foundation established abroad, subject to the foundation deed permitting such a move.

- A Maltese Foundation may uniquely be converted to a Trust and vice versa

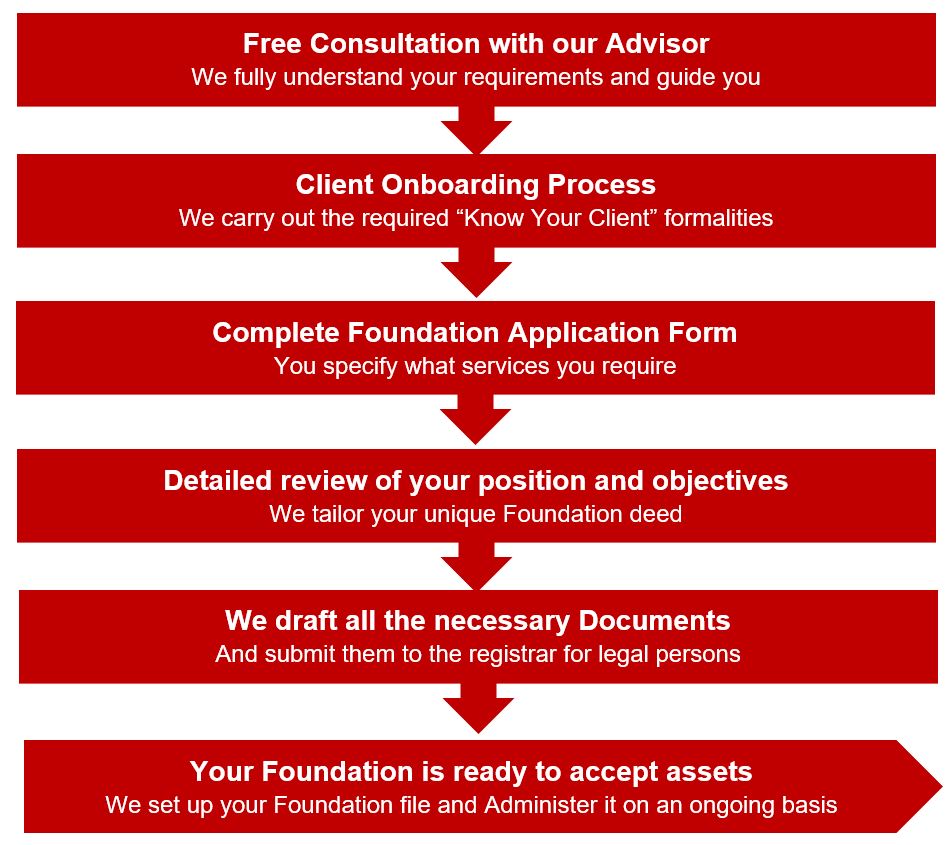

The Process To establish a Malta Foundations

The procedure to set up a Foundation in Malta is simple:

Apart from the Foundation settlement and administration, we may assist you with all the other services you may require for your personal or family wealth protection strategy.

- Tax advice and tax compliance

- Corporate support for any group companies

- Tax efficient ownership of high value assets such as yachts or jets

- Family business review and governance

- Real Estate investment advisory

- Personal immigration options

Overview of Tax on Malta Foundations

A Malta foundation is deemed to be a company for tax purposes, as such the following apply:

- All worldwide income and gains may be liable to tax

- Relief may be available for tax paid abroad

- A foundation that owns one or Malta companies may be treated as a single fiscal unit thus qualifying for the income tax consolidation

- Income arising from Participating Holdings, such as dividends from subsidiaries do not attract tax

- Capital Gains received from the disposal of participating Holdings are not liable to tax

- Anti abuse provisions must be met – these provide certainty

- No tax is applied on Capital remitted to Malta

- 70+ Double Tax Treaties in force

- Distributions to beneficiaries do not create a tax liability in Malta

We specialise in providing tax advice to clients of every size at any stage of their Wealth and asset protection planning, be it pre-setup, specific to a transaction, or in relation to disposal of any family or business asset.

Our Private Wealth Team

We offer foundation services through the duly authorised Claris Capital Ltd. On matters of Private Wealth we have a depth of experience: our 3 Directors and Senior Manager are all TEP, the global benchmark qualification for Trust and Estate Practitioners, and between them offer some 80 years’ experience in the field. We invest continually in our team at all levels and are committed to continuous professional development to benefit our clients.

We have been involved with mainstream assets such as family business, financial portfolios and real estate investments as well as new age holdings such as virtual and digital assets.