Being at geopolitical crossroads, Cyprus enjoys a European political outlook and the lifestyle of a Mediterranean island – which along with its favorable tax regime make Cyprus, the jurisdiction of choice for investors and entrepreneurs. Cyprus has been a member of the European Union since 2004, and a Eurozone Member since 2008. Cyprus companies benefit from the reputation of an EU jurisdiction with cost effective set up fees, as well as highly optimised tax rates.

Table of Contents

Country Highlights

| DOUBLE TAXATION TREATIES: 60 incl. Canada, Russia and China | TIME ZONE: Eastern European Time Zone (UTC+02.00) |

| LEGAL SYSTEM: English Common Law | CURRENCY: Euro € |

| THIN CAPITALISATION RULES: None | EU MEMBERSHIP: Full Member, all EU Directives applicable |

| LANGUAGES: Greek, Turkish, English | NO WITHOLDING TAX: On outbound dividends or interest |

Cyprus Company Formation – Legal Basis

Cyprus Companies are incorporated in terms of Chapter 113 of Cyprus Company Law, which is based on the English Companies Act of 1948. A Cyprus company may be a company limited by shares, or limited by guarantee – and could be either a private or public company. The private company limited by shares is considered to be the most popular structure. Partnerships and charitable purpose organisations can also be established under the laws of the Republic of Cyprus, however – such, are governed by other legislation.

Benefits of setting up a company in Cyprus

- Fast 8 days Process;

- Option of 100% foreign ownership;

- Dividends to a Cyprus resident Co:

- Tax exempt;

- Cost effective set up fees;

- Corporate tax:

- Amongst the lowest in the EU.

Process & Timeline – Cyprus Company Formation

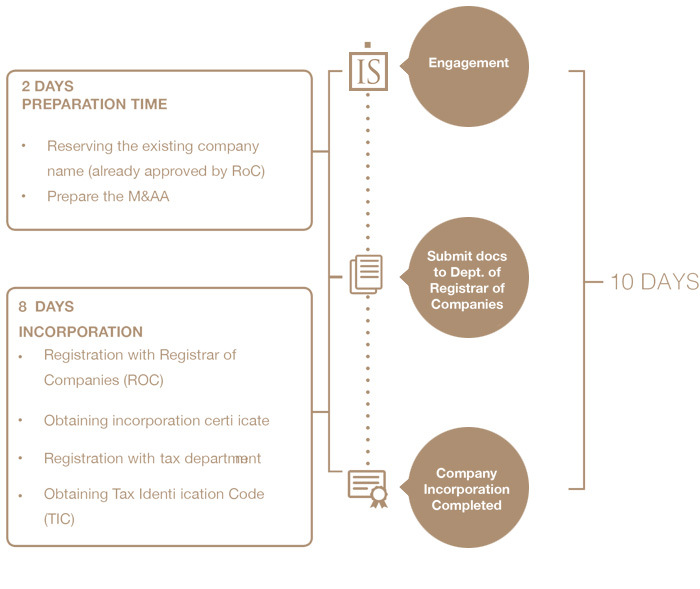

Cyprus company formation process includes 3 phases: Engagement, Submit of docs to the Dept. of Registrar of Companies and Completion of Company Incorporation.

The process takes 10 days:

- 2 Days Preparation Time (reserving the existing company name and preparation of the M&AA

- 8 Days Incorporation (registration with Registrar of Companies, obtaining incorporation certificate, registration with tax department, obtaining Tax Identification Code)

Why Work With Us